NAF Hosts Mad City Money Event for Financial Literacy

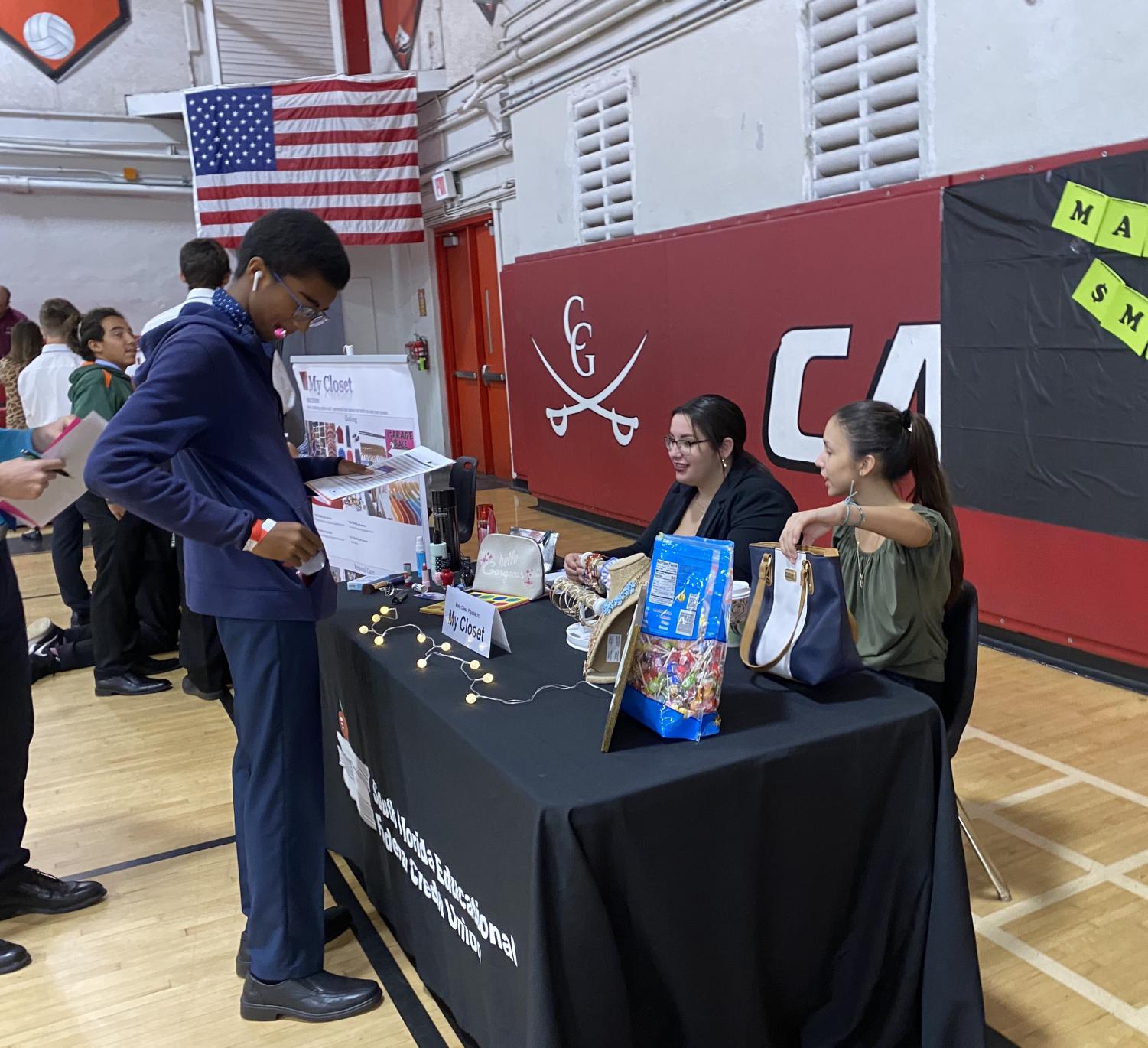

A student examines his options for investing in the mock stock market during the 2019 Mad City Money event.

Dec 20, 2019

Diving into the world of tough financial decisions can be jarring for high school graduates but the National Academy of Finance seeks to make this transition easier by hosting the annual Mad City Money simulation. The event, held in the school gym on Wednesday, Dec. 19, allowed NAF students to apply their lessons on budgeting by spending a “salary” on various expenses, including food, utilities, clothing and insurance.

Mad City Money was organized months in advance by members of the National Academy of Finance board along with faculty advisors. Board members were in charge of running each table and explaining the options to the buyers.

When the first bell of the school day rang, NAF students filed into the gym and were each given a paper containing their career, salary and financial obligations. For instance, life as a police officer yields a salary of $3,000 each month but students with this occupation may also have budget for student loan payments, health insurance or credit card debt.

After receiving their information, students wandered around the gym, examining the stands labeled with different necessities. They were required to pick at least one option at most of the stations, such as one meal plan per person or childcare for young family members.

The choices at each station ranged from the bare necessities to luxury products; there were options to buy both second-hand clothing and low-cost food or brand-name clothing and meals from expensive restaurants.

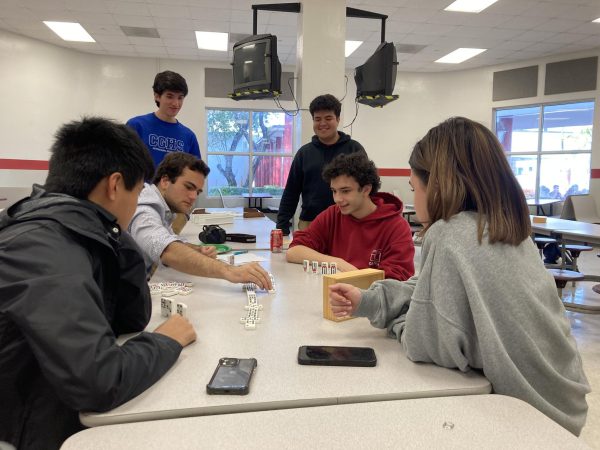

One table popular with the risk-takers was the Stock Market. Similar to the actual stock market, participants had the ability to invest in traditional stocks, along with more unconventional avenues, such as investing in and reselling collectible pieces.

“My favorite part was definitely the stock table. Kids would put thousands of dollars into the market and would wait around the monitor in anticipation of the results. Once the price finally changed, the cheers and groans were easily the most entertaining part,” senior Richard Smithies said.

The NAF students were faced with tough decisions: is eating out at a restaurant weekly going to break the bank? What insurance plan is the best for their designated income? Many strategies used during the Mad City Money event were learned from the business classes that are mandatory for students in this academy. However, as participants saw, it can be challenging to prepare for the unexpected.

At the end of the simulation, students had either accumulated wealth or fallen further into debt. Though not as serious as accruing real-life debt, it offered students a glimpse into the repercussions of certain financial decisions.

“I learned how to save money, what I should spend more money on, what I should spend less money on, and how to prepare for the future,” freshman Andrew Linares said.

While the money was certainly fake and the losses some students experienced had no real-life impact, Mad City Money was a step in the right direction towards NAF’s goal of promoting financial literacy before graduation and making the transition to managing actual financial obligations smoother for Gables graduates as they journey into adulthood.